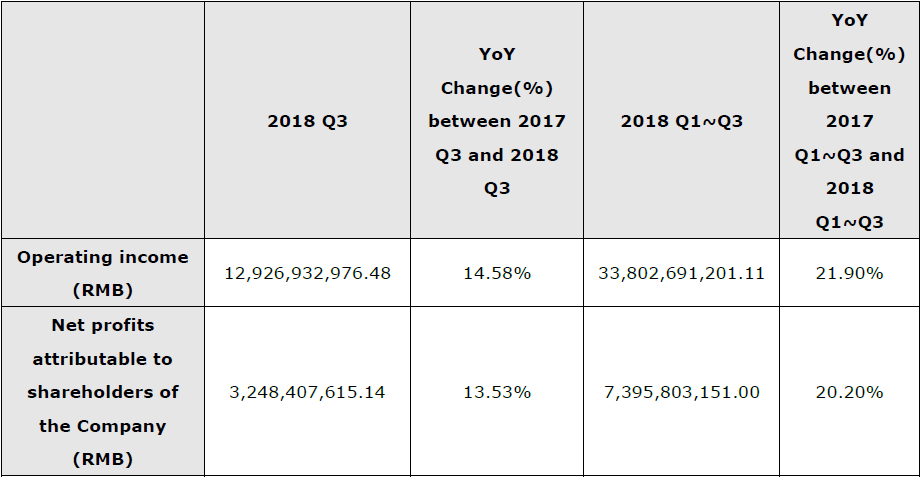

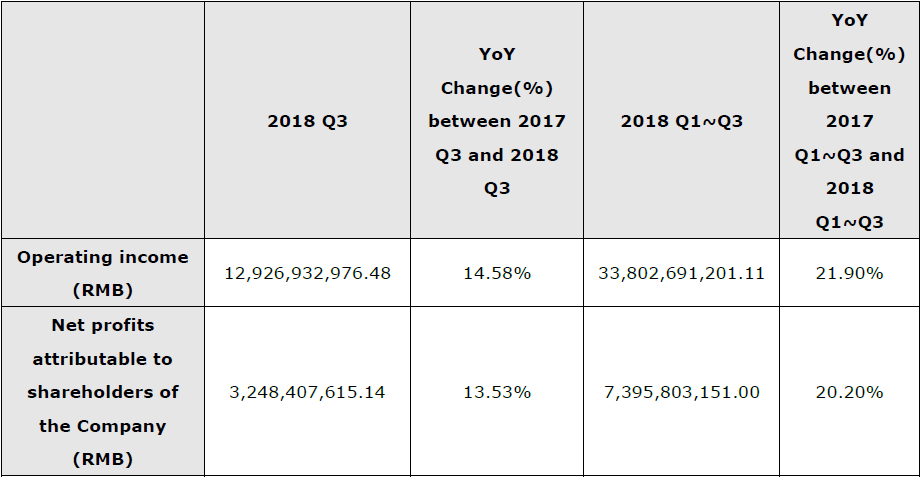

October 25, 2018 Hikvision, the world’s leading provider of innovative security products and solutions, has announced its third quarter financial results, showing a total operating income of RMB 12.93 billion, corresponding to year-over-year growth of 14.58%. Net profits attributable to shareholders of the company was RMB 3.25 billion, corresponding to year-over-year growth of 13.53%.

From January to September in 2018, the company's accumulated operating income amounted to RMB 33.80 billion, with year-over-year growth of 21.90%; and accumulated net profits attributable to shareholders of the company amounted to RMB 7.40 billion, with year-over-year growth of 20.20%.

Key Accounting Data

During the 3rd quarter, the overall business environment faced by the company was challenging due to the slower pace of China’s economy and trade tensions abroad.

Despite these factors, the company remains optimistic for the continuous security industry growth and demand for new technologies and solutions. It is also confident about the expectations for the fourth quarter and the full-year results.

To read a full version of the third quarter financial report, please click HERE.